Revving Up Auto Lending Through a Strategic BPO Partnership That Drives More Profitable Loan Business

Automotive manufacturers are increasingly investing in auto financing as a strategic move to capture more revenue and create a seamless journey for car buyers, from the moment they set their eyes on a vehicle to the exhilarating point of driving off the lot.

A critical touchpoint in this journey, auto financing presents a unique opportunity for dealerships to deliver unmatched convenience, time efficiency, and a spectrum of competitive purchase options at the consumer’s fingertips. Buyers can easily navigate the entire purchasing process, from selecting their dream car to finalizing their finance options, all under one roof. This holistic approach is revolutionizing how customers interact with auto brands, significantly bolstering customer loyalty, deepening dealer loyalty, and turbocharging sales figures for auto manufacturers (OEM).

In this blog post, we explore the transformative power of a car-buying experience supported by outsourced auto financing back office processes that deliver a competitive advantage for auto lenders. An outstanding financing experience fosters lasting relationships that translate into repeat business and a resounding endorsement of the automotive brand. Join us as we demonstrate how strategic BPO partnerships and robust back office support can amplify this experience, turning one-time buyers into lifelong brand advocates.

Back Office Support Fuels Car Sales With Positive Financing Experiences

In its Global Automotive Consumer Study, Deloitte reports that car buyers who have personalized interactions with lenders are three times more likely to be highly satisfied and two times more likely to recommend the lender. PWC’s Automotive Consumer Insights Study reinforces these figures, finding that customers with positive financing experiences are twice as likely to recommend the lender and repurchase from the same brand.

Automakers who create these remarkable financing experiences that customers want to share benefit from improved customer experience ratings, increased loyalty, higher sales, and more loans.

With over 25 years of experience partnering with leading global brands in the automotive sector, iQor helps drive success for clients in auto financing. Through skilled and efficient complex back office support characterized by accelerated income pre-verification (IPV), high quality scores, and higher loan conversion rates, we create positive customer experiences that fuel loyalty among car buyers.

With over 25 years of experience partnering with leading global brands in the automotive sector, iQor helps drive success for clients in auto financing. Through skilled and efficient complex back office support characterized by accelerated income pre-verification (IPV), high quality scores, and higher loan conversion rates, we create positive customer experiences that fuel loyalty among car buyers.

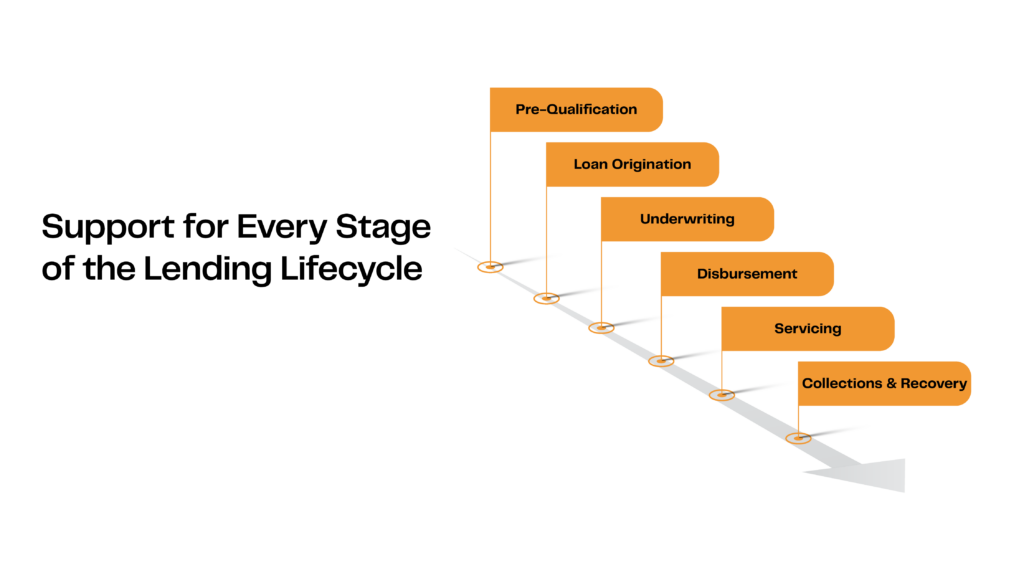

Our auto lending back office CX expertise extends from approving loans and onboarding new borrowers to managing revenue recovery and repayment solutions with patience and agility to build trust and recover more revenue month over month.

Read on to learn how a strategic BPO relationship can help auto lenders harness opportunities like these to attract – and earn hero status with – their borrowers.

5 Benefits of Outsourcing Back Office Support in Auto Lending

Accenture surveyed 7,500 car owners and discovered two key findings that can increase sales and customer loyalty: personalization and stronger dealer relationships. By leveraging innovative technologies, personalization strategies, employee training, and efficient back office support, OEM manufacturers are poised to meet and exceed the expectations of today’s discerning buyers to close more loans faster and at a lower cost.

For more positive financing – and ownership – experiences, more auto lenders are offering a broad spectrum of options driven by expert back office support that adeptly manages critical tasks such as documentation, regulatory compliance, and data management, enabling auto lenders to stay focused on their core competencies.

Here are five benefits of outsourcing back office support.

1. Optimize Performance

BPOs like iQor are adept at optimizing processes for automotive lenders. Our New Program Implementation (NPI) team comprised of inter-departmental leaders performs a holistic assessment of our clients’ business and guides them through the onboarding process with expertise in automation, security, training, coaching, and more to make back office auto lending programs a success from Day One. Highly skilled agents who know the ins and outs of loan terms and processes close more loans with faster income pre-verification response times, improved accuracy, and greater agility to meet ebbs and flows in demand while delivering personalized support for complex issues. Partnering with a BPO also provides the ability to scale operations without additional hiring or capital investments in infrastructure.

2. Achieve Significant Savings

Auto lenders can realize substantial savings, often in the tens of millions of dollars, by partnering with a strategic BPO provider that specializes in nearshore and offshore outsourcing. This strategy reduces costs related to recruiting, training, and retaining employees for back-office support, while also improving efficiency and accuracy. The result is a faster loan closure process. By working with a trusted BPO partner with expertise in nearshore and offshore operations, lenders speed up processes while enhancing cost-effectiveness, leading to increased proficiency and efficiency in their operations.

3. Hyper-Personalize Service

A BPO that offers back office support with a customizable, interactive business intelligence platform can automatically correlate and aggregate data according to the lender’s needs to empower decision-making, solve complex problems, and identify new opportunities to tailor services and interactions to customer preferences. BPOs play a crucial role in refining data management and real-time analytics for auto lenders to improve decision-making and tailor services based on data-driven insights.

4. Leverage Digital Transformation

An approach to digital transformation that applies automation where it matters most can enhance personalization in customer interactions and provide valuable data insights for greater operational efficiency and seamless customer experiences. Robotic process automation (RPA) expedites back office support for loan processing by automating mundane tasks while ensuring data accuracy, improving compliance, and elevating the customer experience. Working with a trusted BPO partner that leverages technology can help auto lenders implement RPA solutions that contribute to higher auto loan conversion rates and improved profitability. Moreover, at iQor, our Symphony [AI]TM generative AI ecosystem combines advanced machine learning models with our decades of accumulated process knowledge to create holistic employee experiences that drive performance.

5. Safeguard Customer Data

In an era where security consciousness is paramount, digital identity verification tools like facial recognition and e-signatures are crucial in mitigating risks of fraud. A BPO with a robust zero trust approach to security ensures back office support that provides peace of mind for the dealer, the lender, and the borrower.

By capitalizing on outsourced back office support for irresistible customer experiences ![]() , auto lenders can build a foundation for long-term brand loyalty and success.

, auto lenders can build a foundation for long-term brand loyalty and success.

Case Study: Back Office Support Exceeds KPIs for Auto Lender

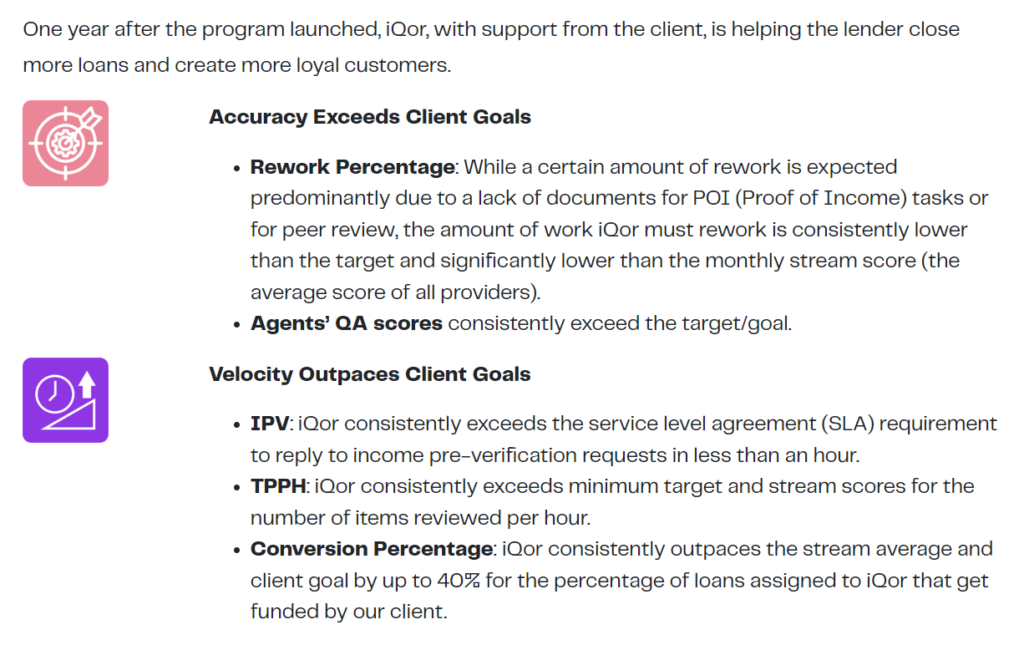

A leading auto finance company has enjoyed remarkable benefits through its decades-long collaboration with iQor. With results consistently exceeding their target KPIs, the lender expanded the partnership to include complex back office support services designed to accelerate loan velocity and improve efficiency and quality while driving down costs.

iQor’s team of back office CX professionals creates smile-worthy experiences through deep product knowledge, brand awareness, comprehensive training, ongoing QA, and compliance monitoring. QA scores are consistently at or above the client’s target with faster turnaround times that secure the lender’s competitive advantage in the auto loan industry.

A Tale of Two Lenders Redefining Auto Finance Through CX Innovation

Two trailblazing captive finance organizations are energizing the customer experience in auto finance through initiatives powered by exceptional back office support.

The first company, the financial services arm of a leading Japanese auto manufacturer, set a new standard with its comprehensive financial tools and resources. Its website is a treasure trove of knowledge, featuring extensive educational materials, intuitive auto finance calculators, and an exceptionally detailed FAQ section.

This innovative lender has also introduced a world-class loyalty program. Its customer-centric ecosystem translates financing into rewards points that unlock myriad possibilities, redeemable for vehicle services, parts, and unique accessories.

Another auto lender, this one for a renowned American auto manufacturer at the forefront of customer experience, has tailored its financing programs to resonate with specific customer groups. Their heartfelt ![]() commitment shines through in their special financing rates for active and retired military personnel. Additionally, they extend a helping hand to those rebuilding their credit, offering specialized assistance that empowers customers to regain financial stability.

commitment shines through in their special financing rates for active and retired military personnel. Additionally, they extend a helping hand to those rebuilding their credit, offering specialized assistance that empowers customers to regain financial stability.

These auto makers are pioneers in customer engagement. Their proactive omnichannel customer service and back office support are staffed by personable and knowledgeable frontline representatives. Their support teams offer tailor-made, compassionate assistance that caters to the unique journey of each customer.

Experience the iQor Difference

iQor is an award-winning managed services provider of digitally enabled business process outsourcing (BPO) solutions trusted by global brands. We understand the unique opportunities available to auto lenders and are ideally suited to help brands create exceptional customer experiences throughout the car buying journey. iQor offers a comprehensive suite of BPO full-service and self-service scalable offerings that are purpose-built to deliver enterprise-quality CX. We provide strategic thought leadership, competitive pricing, performance excellence, attractive geos, and talented teams to meet demand and deliver differentiated customer experiences at the best value in the industry.

Our award-winning CX services include:

- A global presence with 40+ contact centers across 10 countries.

- A CX private cloud that maximizes performance and scales rapidly across multiple geographies on short notice.

- A partnership approach where we deploy agents and C-level executives to help maximize your ROI.

- The perfect blend of intelligent automation for scale and performance coupled with an irresistible culture comprising people who love to delight your customers.

- Virtual and hybrid customer support options to connect with customers seamlessly, when and where they want.

- The ability to launch a customer support program quickly, even when you need thousands of agents ready to support your customers.

- A best-in-class workforce management team and supporting technology to create a centralized organization that can better serve your entire business.

iQor helps brands deliver the world’s most sought-after customer experiences. Interested in learning more about the iQor difference? If you’re ready to start a conversation with a customer experience expert, contact us to learn how we can help you create more smiles.

Susan Halvorsen is vice president of business development at iQor. Connect with Susan on LinkedIn.

![Symphony-[AI]-CTA](https://no-cache.hubspot.com/cta/default/2486145/interactive-151331998599.png)