Tech-enabled processes achieve perfect service level agreements and fortify telecom client’s vital B2B relationships.

Customer

Global Communications ProviderServices Provided

- Back Office

- Cash Application

- Customer Account Reconciliations

- Payment Investigation (PI)

Industry

TelecomLocations

- India

- United States

Why iQor?

For the past 25 years, iQor has partnered with a leading global provider of communication systems, services, and applications. Our long-standing collaboration with the telecom provider and others in the sector allows us to offer in-depth back office support for their high-volume business-to-business (B2B) operations.

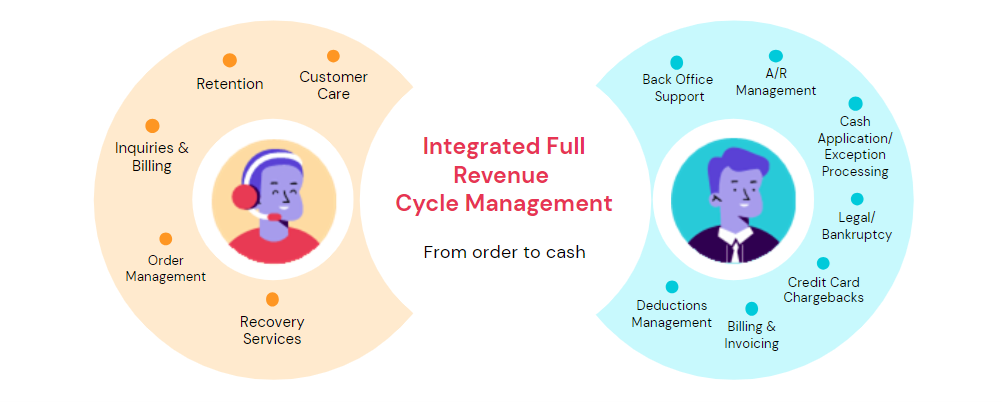

iQor supports telecommunications businesses with integrated full revenue cycle management, ensuring comprehensive order to cash (O2C) service. Clients trust our specialized expertise managing the full continuum of the accounts receivable lifecycle.

When the communications provider required help managing back office cash application processes and resolving millions in backlogged unprocessed payments, they turned to iQor for this specialized support. The client trusts our accumulated process knowledge and expert staff to provide the secure solution they need to address these critical issues.

Customizable Accounts Receivable Management Solutions in Partnership With a Trusted BPO

iQor is uniquely suited to support the client for four key reasons:

- Dedicated Expertise. Our team of cash application specialists brings extensive experience in resolving complex payment processing issues.

- Collaborative Approach. Our partnership philosophy emphasizes working closely with clients to understand their specific needs and required outcomes.

- Secure Technology Solutions. We leverage highly secure web-based technology to ensure accurate and timely cash application.

- Focus on Efficiency and Accuracy. Our solutions prioritize streamlining processes, minimizing errors, and optimizing cash flow.

iQor’s Back Office Expertise in Noida, the IT Hub of India’s National Capital Region

iQor’s global footprint includes sites that offer a compelling advantage for our telecommunications client. Established for over a decade and located in India’s National Capital Region (NCR), our Noida site is a central hub for multinational firms outsourcing information technology (IT) support. Noida’s robust infrastructure includes efficient transportation, booming commercial services, and supportive government policies that enable seamless operations.

Our Noida site boasts a cost-effective and highly educated talent pool with diverse expertise in omnichannel support, and back office functions. This skilled workforce is well-equipped with the latest technology, operating from a facility recognized for its Amazing Workplace status. Our blended offshore-onshore solution delivers impressive quality and performance while lowering costs.

Agents are trained in all aspects of the cash applications process, including compliance standards, industry platforms, and lockbox providers. Our hands-on management team facilitates and simplifies process transition and resource allocation to maximize business advantages.

iQor’s consultative approach with our telecom partner resulted in a multifaceted solution that comprehensively optimizes their cash application process. We successfully achieved a 99.9% exception reduction for a $30 million unallocated backlog—all while mastering the telecom customer’s processes and achieving perfect turnaround times and quality scores throughout our decades of partnership.

Read on to discover the specific challenges addressed, the solutions implemented, and the impressive results achieved, highlighting the positive impact on operational excellence, process efficiency and accuracy, and sustained customer satisfaction.

Success Snapshot

Unstoppable Performance

- Cash application expertise.

- Collaborative approach.

- Established Noida facility.

- Web-based tech solutions.

- Extensive monitoring & reporting.

Irresistible Outcomes

- Processed $30M unallocated backlog.

- Achieved 99.9% exception reduction.

- Met 100% turnaround & quality SLAs.

- Improved cash application visibility.

- Increased payment allocation accuracy.

- Fortified B2B payment experiences.

Background

Cash application is a critical back office function that ensures accurate and timely allocation of incoming payments to customer accounts. This process is essential for every business and can be particularly complex for telecom brands and other industries that generate high transaction volumes.

Many companies manage cash applications internally, using digital lockboxes for pending payment storage. Generally, payments are placed in the correct lockbox, allowing advanced optical character recognition (OCR) technology to extract relevant payment information and use automated systems to match it to the corresponding account.

Why Telecom Organizations Invest in Outsourced Cash Application Services

Optimizing back office processes like cash application allows organizations to streamline operations and support their core business model focus during growth. While legacy systems, resource limitations, and evolving customer needs can impact payment processing speed, modern solutions can help streamline operations, minimize errors, and optimize the overall experience for both businesses and their customers.

To reduce costs and boost efficiency, telecom companies frequently outsource cash application management with a trusted BPO partner. iQor’s cash application specialists handle the labor-intensive process of matching payments to invoices, often leveraging automation for faster turnaround. By strategically outsourcing this function, telecoms free up internal resources for core business activities.

Business Opportunity

Accurate cash application requires skilled agents and proven processes to achieve timely payment resolutions. For example, identifying duplicate payments, researching missing account information, or resolving application delays requires experienced support to resolve millions in unallocated revenue.

iQor collaborated with the telecom brand’s internal teams to find areas of opportunity within their accounts receivable business operations.

Our client generates millions of invoices annually for their worldwide B2B customer base. To ensure efficient cash flow, we work together to streamline their cash application operations, a critical component for managing exceptions to pending customer payments and maintaining optimal revenue flow.

We identified an opportunity to improve efficiency in handling lockbox exceptions. Initially, around $30 million in unapplied payments were unresolved, creating friction for our client’s valued B2B customers.

Maximizing Outsourced Cash Application Benefits at Scale

By outsourcing cash application processes with iQor India, businesses can benefit from:

- Improved Efficiency. Our team can help identify areas for improvement and implement streamlined workflows for faster processing.

- Increased Accuracy. We utilize a combination of technology and human expertise to ensure payments are accurately allocated.

- Reduced Costs. Our blended onshore and far shore team offers cost-effective support compared to building and maintaining an in-house team.

- Targeted Focus. By delegating cash application tasks, businesses can free up internal resources to focus on core competencies.

iQor’s approach is scalable, enabling businesses to ramp their cash application support up or down as their needs evolve. We adapt our solutions to support changing customer bases, transaction volumes, and new payment methods.

By partnering with iQor, our telecom client benefits from a combination of expert teams and tech-enabled processes. Our specialists possess extensive experience in resolving these common issues efficiently, ensuring prompt and accurate application of all received funds.

Solution

iQor’s accounts receivable solution began with a thorough assessment of the telecom provider’s cash application process. Our cash application specialists identified areas for improvement, including streamlining time-consuming tasks and centralizing operations. Our iQorian value of clear, open communication with the telecom organization’s finance department facilitates the achievement of their back office business goals.

Building a Secure and Efficient Foundation to Cash Application Process Improvement

iQor prioritizes early detection of issues, accurate invoice identification, effective coding, and rigorous tracking and quality checks throughout every stage of the cash application transformation. Our processes provide higher efficiency at lower cost through accurate forecasting, process maps, and metrics-tracking for improving turnaround time and quality.

Our strategy is focused on three key pillars designed to optimize the client’s time-sensitive cash application process while prioritizing accuracy, security, and efficiency.

1. Leverage automation expertise to boost payment-matching efficiency.

iQor implemented our web-based technology to accelerate the cash application cycle for all cash receipt-related processes such as refunds, payment investigation (PI), account clearing, and fund transfers.

By integrating seamlessly with our telecom client’s existing systems, we facilitated a smooth and efficient flow of payment data. This improved processing speed and minimized the risk of human error, protecting the communications provider’s sensitive customer financial information.

2. Develop collaborative and consistent cash application procedures.

iQor recognized the importance of standardized procedures in maintaining a streamlined and accurate cash application process. Through a collaborative effort with the client, we developed a clear set of well-defined cash application policies.

These standardized procedures established a consistent framework for handling payments, fostering clarity, reducing the potential for errors and exceptions, and ensuring that the new policies aligned seamlessly with the client’s existing financial controls and internal workflows.

3. Commit to transparent monitoring and reporting that builds client trust.

Transparency is a cornerstone of iQor’s partnership approach. We provided comprehensive reporting and tracking tools to gain valuable insights into their cash application performance. These tools offered detailed information on key metrics, including daily processing volumes, exception rates, and reconciliation status.

Our accounts receivable experts utilize iQor Connect, our proprietary ticketing tool that ensures our customer’s asset management team and other stakeholders are reliably informed through every stage of the program’s evolution.

We also provided monthly journal entries to support the client’s general ledger balancing and offered dedicated support for annual escheatment processes. This level of transparency empowered the client to make data-driven decisions, identify areas for further improvement, and ensure ongoing process optimization.

By implementing this solution, we achieved a significant reduction in turnaround time. The client now enjoys a daily cash application cycle of under 24 hours, a dramatic improvement from previous processing times. This demonstrates the effectiveness of our partnership in optimizing efficiency, accuracy, and ultimately, the telecom organization’s cash flow.

Results

The initial lockbox unallocated backlog of $30 million presented a challenge for efficient cash application. An outsourcing partnership with iQor improved these critical processes while achieving perfect service level agreements (SLAs):

Eliminated $30 million lockbox unallocated payments, a 99.9% reduction.

Met 100% service level agreements on turnaround time and quality.

Improved visibility into the cash application cycle through web-based technology and process improvements.

Provided more accurate allocation of payments by optimizing lockbox processes and minimizing exception errors.

Leveraged our established Noida site in India’s National Capital Region (NCR) to ensure operational excellence and client satisfaction.

Strengthened B2B customer relationships by reducing the backlog, quickly resolving payments, and providing more informed and positive CX.

The Future Roadmap for Cash Application Operational Excellence

In today’s fast-paced business environment, a streamlined cash application process is a cornerstone of financial health for all organizations in all industries. iQor provides teams, global footprint, resources, and proven solutions to unlock the full potential of cash application operations, customized to the needs of the business. Together, the telecom provider and iQor set a high standard for accurate and efficient payment processing, equipping our client to deliver customer service with a smile. ![]()